“Invest in mutual funds”!

This is what TV commercials are promoting, and the same advertisement came to the attention of Mr Akash, who was watching the ICC T20 world cup on his TV.

Mr Akash knew it was related to the future but didn’t know how to invest in mutual funds.

If you are also on the boat on which Mr Akash is travelling.

This Blog is for you, where you will educate yourself about investing in the mutual fund.

Before this, also read about what is mutual fund. And its different types.

As previously described in my previous blog about mutual fund, It is professionally managed investment basked that compound your money over time. Mutual funds can invest in several products, such as stock, debt, and money market funds, and get a good return on your money. There are more reasons to invest in mutual funds, and I have highlighted the most important ones for you below:

Regular investing in a specific financial instrument can help you create enormous wealth. SIP(Systematic Investment Plan) is the feature that helps investors invest in small amounts regularly.

You can decide whether you want to invest weekly, monthly or quarterly. Auto-Debit feature can also be turned on while setting the SIP in which the fixed get auto-debited from your bank account.

When I started investing, I didn’t have that much money, and I am assuming you are in the same boat.

You can invest in a mutual fund with less amount. You don’t have to collect much money to invest in a mutual fund. You can start investing in mutual funds as low as Rs. 500 for a monthly SIP.

Brokers are offering their customers to invest in mutual funds. They have a specific dashboard for investing in mutual fund. You may begin investing in a mutual fund plan by clicking a few buttons. Even the KYC procedure is now available online, with investors able to contribute up to Rs.50,000 via the e-KYC facility. However, for investments over Rs.50,000, investors must complete the physical KYC process.

When we invest somewhere, we all are interested in return. Compared to fixed deposits, mutual funds offer better returns on your investments with the help of different instruments.

One needs to keep in mind that, It comes with a high degree of risk.

The mutual fund gives you exposure to different financial instruments simultaneously. You can experience international investment, debt, bond, and T-bills investments, too, with a very small amount of money.

In a mutual fund scheme, a dedicated and professional fund manager will manage your money and try to reduce the risk. They are professional in their work and have a designed procedure for making investments which goes from collecting the data, analyzing the data, researching the data, forecasting the data and then investing.

Those who don’t have much time to follow these steps and don’t have time to track the market. They can go for mutual fund schemes.

In the world of finance, everything goes with forecasting and planning. Here also you need to ensure some important things which will help you get high returns on your investments.

You need to specify your goal. Not only at the time of investing in a mutual fund, but before any investment, you need to make sure about the goal of your investment.

You must also select the time horizon you will invest in the scheme. Time horizon is also important because mutual fund company offers short-term and long-term schemes.

One needs to understand the risk profile. Whether you are taking the advice of a financial advisor, you should know your risk profile before investing in any of the financial instruments. It varies from person to person.

After knowing the risk profile, you will easily know which suits you best. Whether it is debt investing or equity investing, or is it a mixture of both?

Once you’re done with the investment options, you can select a mutual fund scheme that matches your risk and goal profile.

Here, you must carefully read the scheme information document, which will help you analyse the mutual fund scheme. Also, check their objective.

After selecting the mutual fund, you must decide whether you will invest regularly or only once. If you want to invest regularly, you must opt for SIP.

If you are a beginner, I highly recommend you go for SIP because your investment won’t be affected by market volatility.

Based on category, type, and structure, I have written all types of mutual funds

Permanent mutual funds are open-ended, allowing you to invest and redeem investments at any time. They have no defined investment time and are very liquid. If the mutual fund is open-ended, you can purchase it even after the NFO period has finished.

Closed-ended securities have a defined maturity date. You may invest only at the time of the new fund offer, and you may redeem only at maturity. You cannot acquire units in a closed-ended mutual fund whenever you desire. If the NFO period has expired, you will be unable to purchase closed-end funds. If you still wish to buy, you can do so through stock exchanges.

If a closed-ended fund has a 5-year maturity date and you wish to sell your units, you must do it on a stock market. Because there are less customers for it, you may have to sell it for a lower price.

Stock mutual funds are mutual funds in which the fund management solely invests in the equity market, which implies only in shares.

When it comes to equity mutual funds, one thing to keep in mind is that they are intended to be long-term investments. Every business need time to demonstrate its worth.

If you are a short-term investor, avoid equity mutual funds since stocks can be volatile in the near term.

Debt mutual funds are mutual funds in which the fund management exclusively invests in the debt market, which means he or she only invests in debt instruments such as debentures, bonds, T-bills, and so on.

Hybrid funds are those that invest in both equity and debt financial instruments.

These funds are managed by fund managers, who examine the market before investing. Fund management will make the choice. The majority of mutual funds are active mutual funds since they are managed by mutual fund managers and so have a higher management charge than passive funds.

These funds are not managed by fund managers; instead, they adhere to passive investment by tracking market indices.

The asset management company is the company that manages your assets; in the case of mutual funds, it is NAV. In Indian Equity Market, more than 40 companies are operating in the domain of Assets Management.

You can directly reach out to them if you want to invest in the mutual fund. Go to their official website.

After checking the website, you can decide on the mutual fund scheme you want to invest in.

They work as a bridge between you and the mutual fund scheme. You can look at all mutual fund schemes and compare which suits you best.

Mutual Fund distributor is not biased on any specific mutual fund scheme.

They help investors like you and me to find the best mutual scheme. They earn commissions from mutual fund investments. They understand investors’ situations, risk tolerance, level and financial goals to suggest the mutual fund scheme.

It can be a company or an individual also. Banks and Non-Banking Finance companies can also perform like mutual fund distributors.

They usually suggest a regular plan as they earn commission from it. They can charge a fixed fee or pay some percentage of their portfolio.

In India, more than 85,000 financial advisors can advise you in selecting the appropriate mutual fund scheme.

You can seek their consultation. You need to ensure that SEBI and AMFI should authorize the financial advisor.

One needs to pay fees in the form of fixed fees or commissions, or a combination of both.

After Covid-19, we have seen tremendous growth in the customer base of brokers, whether discount or regular.

Nowadays, Brokers like Upstox and Groww offers their customers to invest in mutual fund. They have a dedicated platform for this feature where you can analyze the mutual fund scheme.

They charge 0% commission for investing in mutual fund. You need to open a demat account with them, and in the same demat account, your mutual fund units will be stored.

This is what I follow. I have my account on upstox.

You need to open a demat account with them. Do the eKYC with them, and you are good to go. You can access all mutual fund schemes and invest in them.

After successfully opening the demat account, you need to sign in with upstox pro.

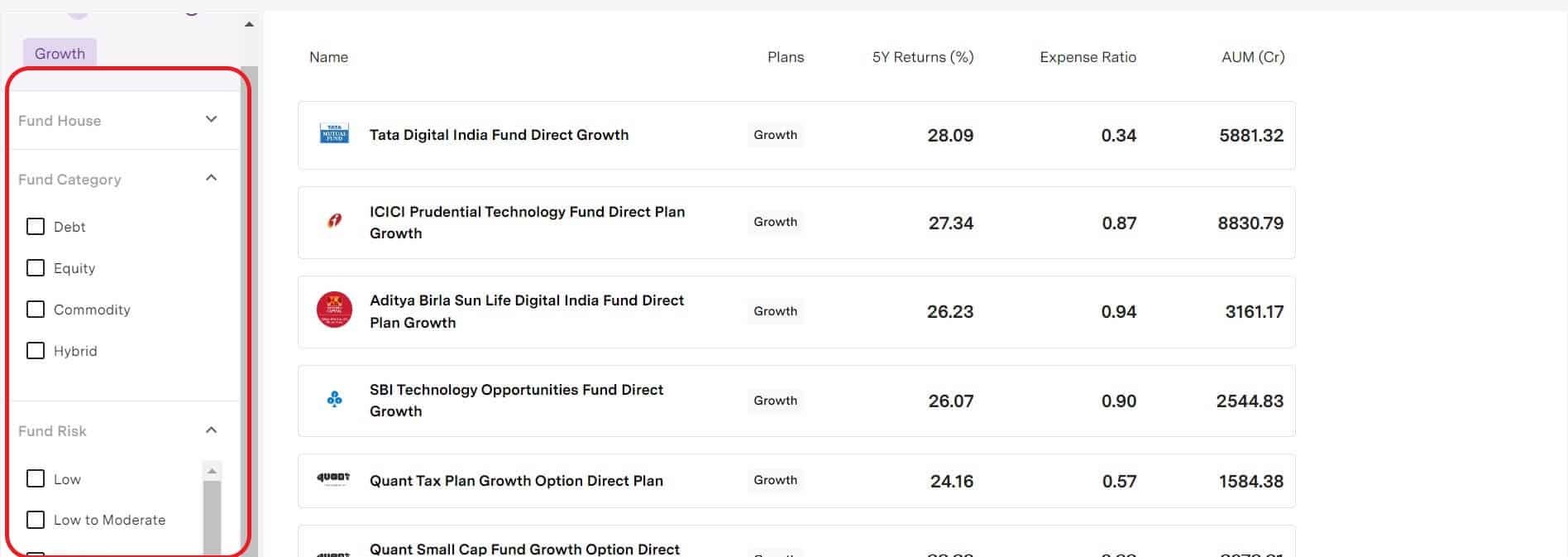

Once you are logged in, you will see this screen.

Click on MF. This will take you to a dedicated dashboard of the mutual where you can track all your mutual fund investments.

Now you are at your dashboard of mutual funds, where you will see lots of mutual fund investments.

Also, you can see many filters which you can adjust according to your risk capability and goal.

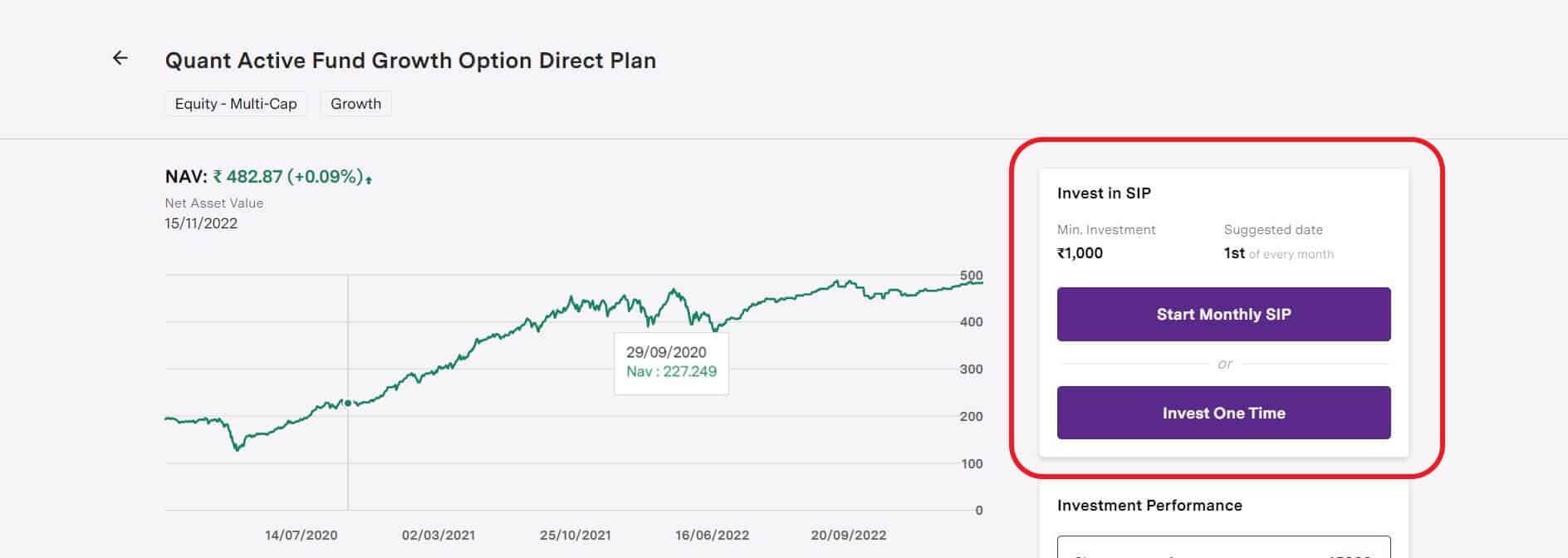

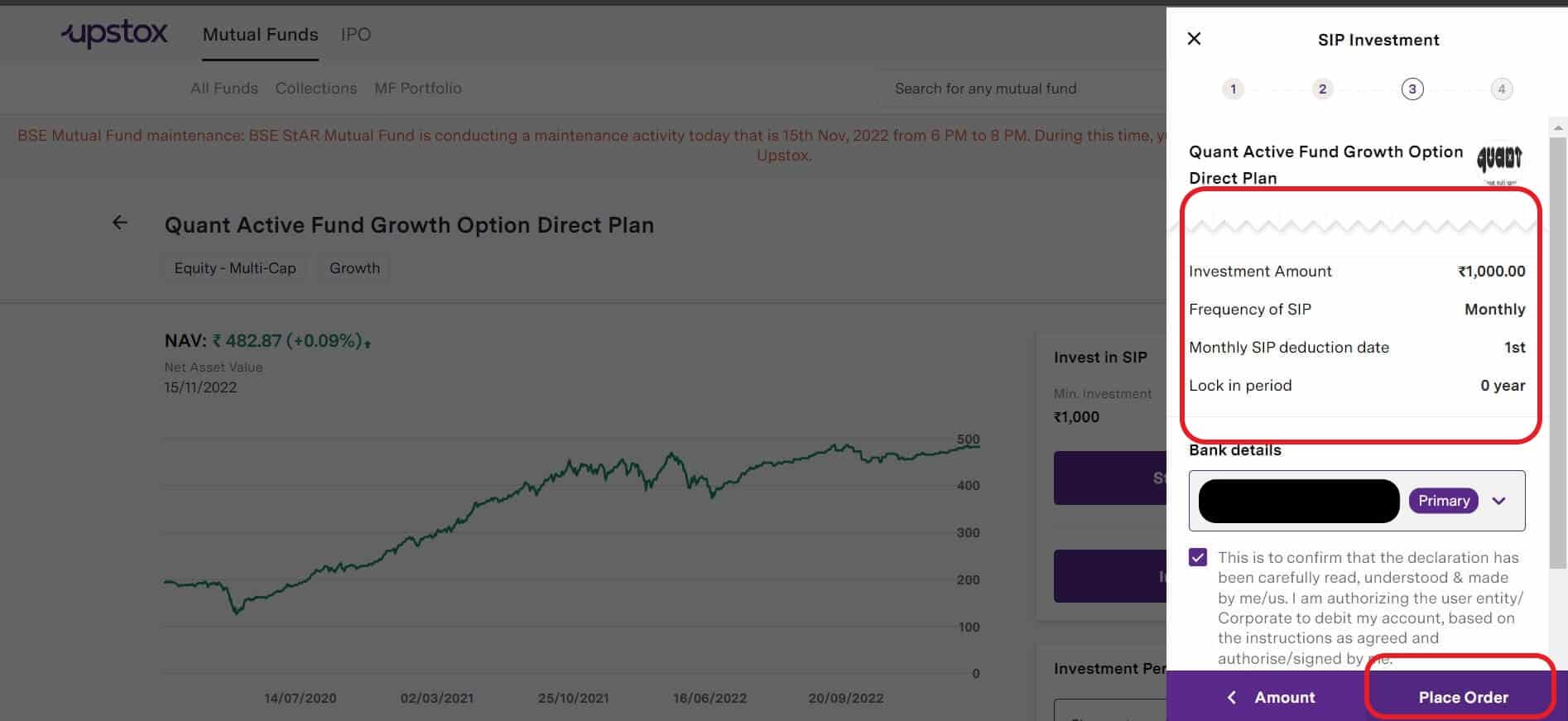

To show you, I have opened a random mutual fund scheme for you.

Here you can see that it gives you option to start a SIP or invest for one-time(lump-sum)

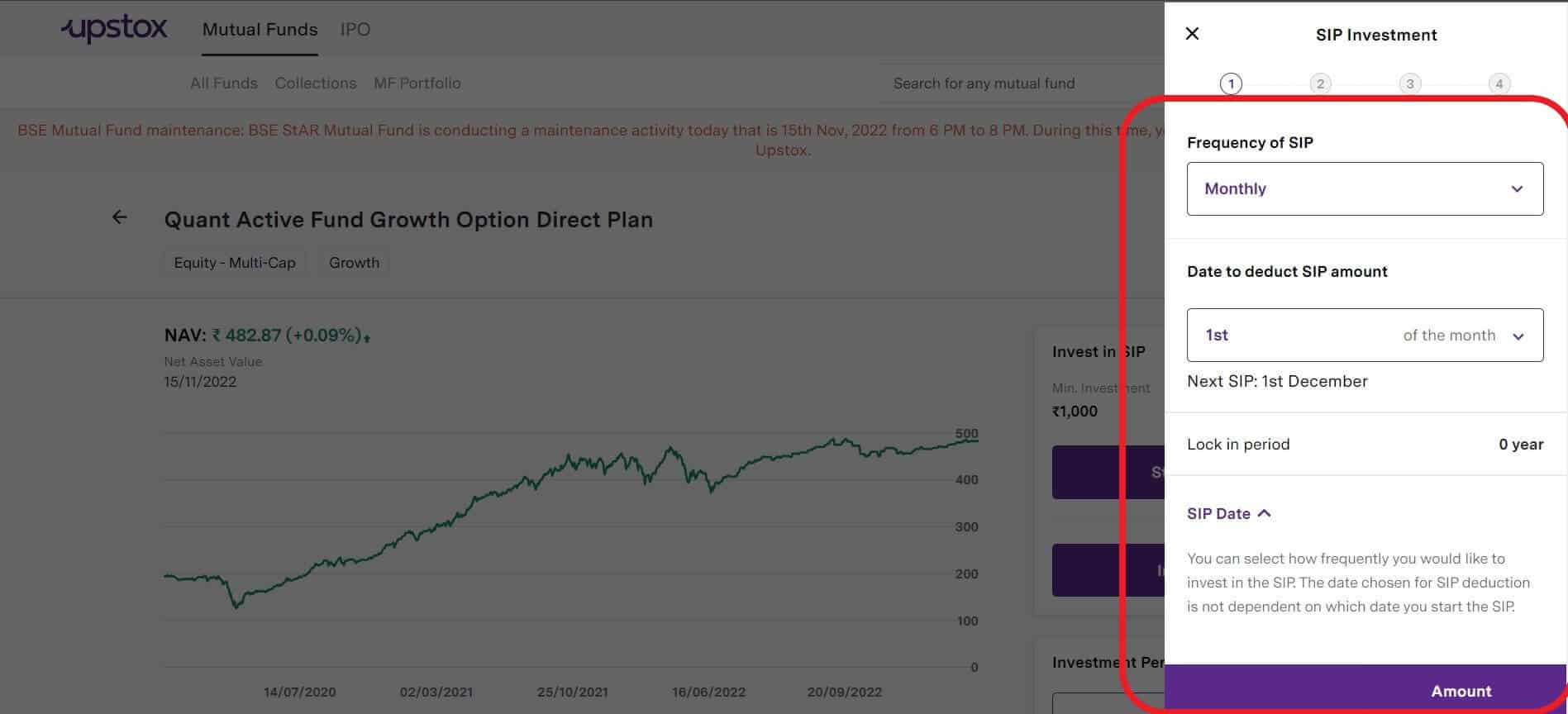

I have selected SIP, and here you can see I can select the frequency and the date for which i will be investing regularly.

Now it’s time to review my order and confirm the order.

Slow and steady wins the race. This is how Mr Buffet won the race for one of the richest people on the planet. To become you need to invest for a longer period.

I hope you enjoyed this guide on how to invest in mutual fund. It all depends on your goals and risk.

Earn Money, Save money and Invest it into the mutual fund so that you can grow with the growth of this country. Don’t expect returns from your mutual fund scheme at the start. You have to give time to your investment so that it can grow.

So Invest for the Long-Term.

If you have any queries, leave your comment i will respond to it.

Thank You

Logging Out!

Rupay Rajat

Rupay Rajat is a financial and investing blog. I write about financial instruments and the stock market in the most easiest language.

Latest Post

Let’s Unveiling the Power of Compounding in the Stock Market

Mutual fund vs Fixed deposit – Where should you Invest?

How to invest in Mutual Funds? Easy Ways to Invest

What is Mutual Fund? Simple Types of Mutual Fund

29 Best Stock Market Websites (Useful Websites and Apps)

What is the difference between share market and stock market?

How the Stock Market Works in an Unusual Way

What is the Buyback of shares? What happens after Buyback?

What is Bonus Share? How Can I get One?

What is Stock Split? What will happen to shares after that?

What is the Book Value of a share? Valuation Metric of Share

What is the Face Value of the Share? Importance, Example

What are the voting rights of a shareholder? Importance

What is an Adjustable peg? Effect of Forex Market

What is Adhoc Margin? Who Collects from Whom?