My Content is reader-centric, which means if you click on some of the links, I may earn a small commission.

To understand the power of compounding in the stock market, first, you need to understand the basic compound interest. The style of investing has always been evolving decade by decade where you will see different concepts of contra investing, concentrated investing, and many more but there is one thing which hasn’t changed not from decades but from hundred of years.

Consider a snowball, when the snowball slides from a high altitude then it will grow all its way and gets bigger in its size. compounding is often referred to as the “snowball effect” because as the investment grows, the potential for larger returns increases, resulting in accelerated wealth accumulation.

Compounding has the true potential to make your investment into great wealth over a long period of time.

To get a clear picture of compounding first we need to understand the types of interest, one is compound interest and another is simple interest.

Compound interest is the investment where the return gets re-invested back along with the principal investment amount. Here you are getting more interest on the interest that you had already earned whereas in simple interest you will earn interest only on the principal amount which you have invested.

To understand the power of compounding, one needs to understand compound interest first. There are two types of interest- simple interest and compound interest. In compound interest, the investment return gets re-invested back along with the initial investment amount.

The power of compounding in the stock market is just a niche downed topic of compounding in an investment sense but it is way more than this. It is a concept that investors and financial experts have widely discussed. A secret sauce to wealth creation, But what exactly is compounding and how can it help grow your health in the stock market its benefits, historical examples, compounding strategies, the importance of time and patience, risk management, and expert advice.

Compounding in the stock market refers to the process of reinvesting the returns generated from investing back into the portfolio of your stock market. This will allow those returns to generate additional earnings over time. This will help you to grow your exponential over a long period of time.

If I talk about legendary investor Mr. Warren Edward Buffet who has built great wealth over the years. You must notice that his initial investment was small. He has earned not only his initial investment but also the accumulated profits and gains from previous investments which lead to wealth accumulation over the long term.

For the stock market, compounding can do its work in two ways, one is capital appreciation and another is dividends. Capital appreciation is nothing but an increase in the stock value which you are already holding.

If you want to experience the true power of compounding in your stock market portfolio, you need to understand how it works in investment. It is also important for you to know how stock market works.

Compounding in the stock market has numerous benefits but let’s look at some of the important ones.

When it comes to the power of compounding in the stock market, then those investors can teach you better about the power of compounding who has experienced it.

Warren Buffett: The legendary investor Warren Buffett is a prime example of the power of compounding in the stock market. Buffett’s long-term investment strategy and focus on compounding have helped him amass a fortune worth billions of dollars.

The Coca-Cola Company: Coca-Cola is another excellent example of compounding at work. If you had invested $1,000 in Coca-Cola in 1962, your investment would be worth over $200,000 today, thanks to the power of compounding.

S&P 500 Index: The S&P 500 Index, which tracks the performance of the 500 largest publicly traded companies in the United States, has delivered an average annual return of around 10% since its inception in 1926. This means that a $1,000 investment in the index in 1926 would be worth over $7 million today, thanks to the power of compounding.

Let’s also talk about Indian Market too.

Infosys: Infosys, a prominent Indian multinational information technology company, has demonstrated compounding in the stock market. Since its listing in 1993, Infosys has consistently grown its business and delivered robust returns to shareholders. The compounding effect, combined with the company’s ability to adapt to changing market dynamics, has contributed to the creation of significant wealth for long-term investors.

Bajaj Finance: Bajaj Finance, a non-banking financial company (NBFC) in India, has been known for its impressive stock performance and compounding effect. The company has experienced significant growth, offering a range of financial products and services. Patient investors who have held Bajaj Finance stock and reinvested dividends have benefited from the compounding effect, witnessing substantial wealth accumulation.

Learning compounding strategies for the power of compounding in the stock market is crucial for several reasons. By understanding and applying these strategies, investors can maximize their potential for long-term wealth accumulation. Here are the some strategies which you can use for your portfolio.

Diversification is a strategy that involves spreading investments across different asset classes, sectors, or geographies. By diversifying their portfolio, investors can reduce the impact of any individual investment’s performance on their overall returns. Diversification helps mitigate risk and allows investors to benefit from compounding across a broader range of investments.

Investing in growth-oriented stocks or mutual funds can be a compounding strategy. Growth investments are focused on companies or funds with strong growth potential. By selecting such investments and allowing them to compound over time, investors can benefit from the capital appreciation and compounding effect of high-growth assets.

Dividend reinvestment is a popular compounding strategy. Instead of taking cash dividends, investors can choose to reinvest them by purchasing additional shares of the stock. This strategy allows investors to compound their returns by increasing their ownership in the company and potentially benefiting from future dividend payments and capital appreciation.

SIP is a disciplined investment strategy where investors regularly invest a fixed amount at predefined intervals, regardless of market conditions. This strategy takes advantage of cost averaging and allows investors to buy more shares when prices are low and fewer shares when prices are high. Over time, the compounding effect of regular investments can lead to significant wealth accumulation. Therefore, it is very important to stay consistent if you want to maximize the power of compounding in the stock market.

Adopting a long-term investing mindset is a fundamental compounding strategy. By staying invested in quality assets over an extended period, investors can benefit from the compounding effect. This approach involves resisting the urge to make frequent trades based on short-term market fluctuations and focusing on the long-term growth potential of investments.

To determine how the power of compounding in the stock market helped you in earning compounding returns, First, you need to learn how to calculate compounded returns.

Price Appreciation = ((Ending Stock Price – Starting Stock Price) / Starting Stock Price) * 100

This will show the power of compounding in the stock market in percentage terms.

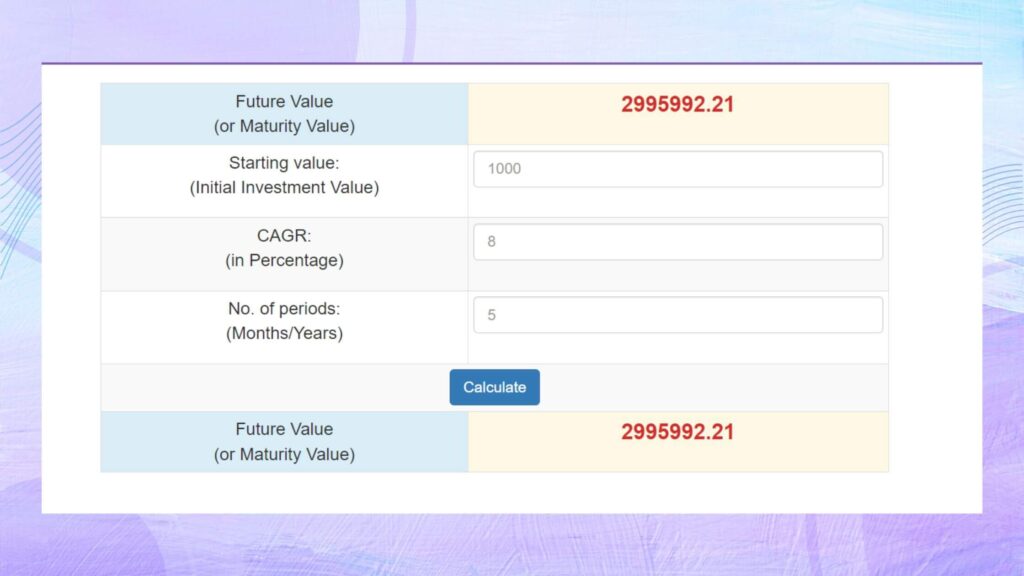

I found this cool tool that you can use as a compound interest calculator.

Here you just need to enter three things only, First, you need to enter How much amount you have invested? Second, How much % return do you expect Third, For much time you will be invested in the financial instrument?

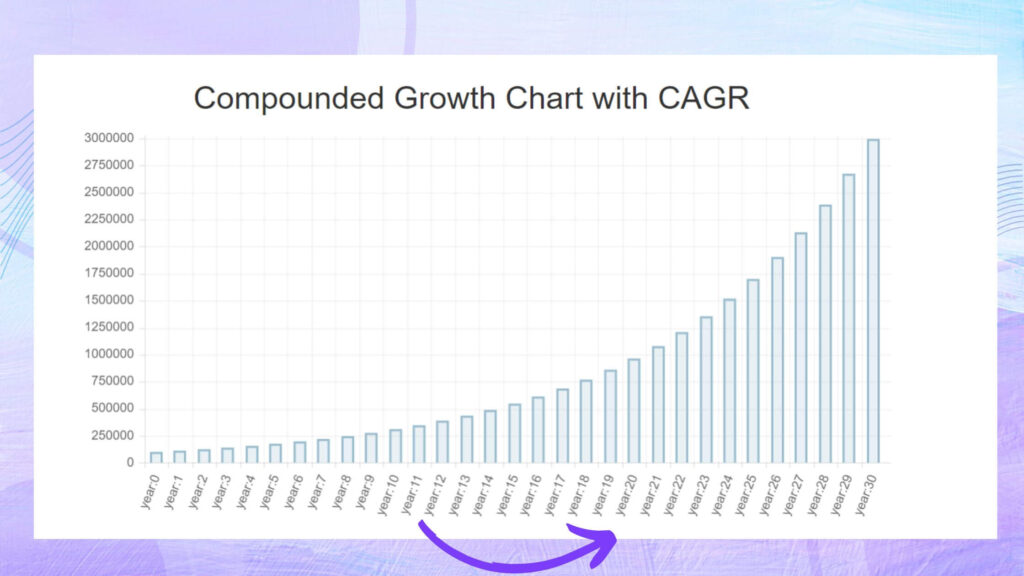

Let’s Take the Example, That I will be investing Rs.1,00,000 for 30 years and I will be expecting a 12% return.

Just see in the graph, To convert Rs. 1,00,000 into Rs, 10,00,000 your investment took almost 20 years. But to reach the next Rs,10,00,000 your investment took only 6 years.

So here you can see that Time is the only horizon that is making a difference. You see how the power of compounding in the stock market maximized in recent years.

To maximize the potential of compounding in the stock market, it is important to be aware of common mistakes that should be avoided. One of these mistakes is failing to take a long-term perspective when investing. Many investors are tempted to engage in short-term trading based on immediate market fluctuations. However, by focusing on the long-term growth potential of investments, investors can fully leverage the power of compounding.

Another mistake to avoid is trying to time the market. It is extremely challenging to consistently predict the movements of the stock market accurately. Attempting to time the market often leads to suboptimal results. Instead, it is recommended to stay invested and remain committed to the chosen investment strategy, regardless of short-term market volatility. By staying invested over the long term, investors can benefit from the compounding effect.

Another critical mistake is neglecting the importance of diversification. Concentrating investments in a single stock or sector exposes investors to higher risks. To mitigate risk and optimize the power of compounding, it is crucial to diversify investments across different asset classes, sectors, or geographical regions. Diversification provides a broader opportunity for growth and helps protect against the impact of any single investment’s performance.

Neglecting the reinvestment of dividends is another mistake to avoid. Dividends can significantly contribute to overall returns. By reinvesting dividends back into the stock or the market, investors can further enhance the compounding effect over time. Considering the reinvestment of dividends as part of the overall investment strategy can lead to greater long-term wealth accumulation.

Chasing after hot tips or investing in trendy stocks without proper research is a common pitfall. Such speculative investments often result in disappointment and may not provide sustainable compounding growth. It is important to conduct thorough research and invest in companies with strong fundamentals and long-term growth prospects. A prudent approach based on solid analysis can maximize the benefits of compounding.

Emotional decision-making is another mistake that can hinder the power of compounding in the stock market. Allowing emotions, such as fear or greed, to drive investment decisions often leads to impulsive buying or selling, which can have detrimental effects on long-term returns. Investors should strive to make rational decisions based on careful analysis and adhere to a well-defined investment plan.

Lastly, neglecting to regularly review and rebalance the investment portfolio is a mistake that can hinder the power of compounding. Market conditions and investment performances change over time, leading to deviations from the desired asset allocation. Regular portfolio review allows for adjustments, ensuring that the portfolio remains aligned with investment goals and optimizes the benefits of compounding.

By avoiding these common mistakes, investors can enhance the power of compounding in the stock market. Maintaining a long-term perspective, exercising discipline, diversifying investments, conducting thorough research, and making rational decisions are key elements in fully realizing the benefits of compounding.

In conclusion, compounding in the stock market is a powerful tool that can significantly enhance an investor’s wealth over time. By understanding the principles of compounding, adopting a long-term perspective, and implementing sound investment strategies, investors can unleash the full potential of compounding and achieve remarkable financial success. Throughout this guide, we will explore various compounding strategies, delve into real-life examples, and provide actionable insights to help you navigate the intricacies of the stock market and harness the transformative power of compounding.

I hope you enjoyed the post and learned about how can you maximize the true power in the stock market. Do let me know in the comment section if you face any difficulty.

Till Then

Happy Investing

Rupay Rajat

Logging Out !

Rupay Rajat is a financial and investing blog. I write about financial instruments and the stock market in the most easiest language.

Latest Post

Let’s Unveiling the Power of Compounding in the Stock Market

Mutual fund vs Fixed deposit – Where should you Invest?

How to invest in Mutual Funds? Easy Ways to Invest

What is Mutual Fund? Simple Types of Mutual Fund

29 Best Stock Market Websites (Useful Websites and Apps)

What is the difference between share market and stock market?

How the Stock Market Works in an Unusual Way

What is the Buyback of shares? What happens after Buyback?

What is Bonus Share? How Can I get One?

What is Stock Split? What will happen to shares after that?

What is the Book Value of a share? Valuation Metric of Share

What is the Face Value of the Share? Importance, Example

What are the voting rights of a shareholder? Importance

What is an Adjustable peg? Effect of Forex Market

What is Adhoc Margin? Who Collects from Whom?