Give yourself a pat on the back !

As you have decided to learn about “what is mutual fund”? and somewhere you want to invest in it but as an Intelligent Investor first you want to get basic knowledge about “What is mutual fund investment”.

What comes to mind when you hear “What is Mutual Fund”?

You must have seen an advertisement where cricketers are promoting mutual fund investing.

Have you noticed in the same advertisement that cricketers emphasize on long- term investing?

Let’s look at what mutual fund means.

A mutual fund is a basket of financial instruments managed by a specific manager. This person will be treated as a mutual fund manager.

It is a company/trust/organization/firm which collects money from people like you and me and invests that same money in financial instruments such as stocks, bonds, etc.

Investors like you and me invest in the scheme of the mutual fund company for which we get units of the same mutual fund. Just like all combined holding of your assets is your portfolio. Similarly, integrating all mutual fund company holding assets will be called a mutual fund portfolio.

I hope you understand the basic definition of “What is mutual fund”?

If money exists in this world, then there should be a manager for it who can grow that same money. People are trying to learn this skill, and those who are perfectionists in this skill they will be called money managers.

For mutual fund companies, The one who manages the money or decides where the money should be invested will be called a mutual fund manager.

Since they are managing money, you can assume how much expertise they have in analyzing and managing financial instruments. Fund managers also decide when and where to invest the money, among many other responsibilities.

Companies working on a mutual fund model can also create an asset management company or fund house which will manage other people’s money.

The company that manages the fund will be treated as Asset Management Company.

Every person has some vital objective in this world. Similarly, the mutual fund has some objectives in the finance world, and according to these objectives, the mutual fund manager decides the investment.

For managing investors’ money, the company charges a fee known as a management fee.

You can find all the mutual fund’s objectives in a scheme information document.

Some mutual funds aim to invest in only Large Cap companies where there can be less risk and more stability.

Please read this document carefully before investing in any mutual fund scheme.

After reading this document, you will be able to answer yourself. What is the best mutual fund to invest in? You can also consider this document which briefs you about mutual fund information.

Mutual fund offers good investment options to retail investors like you and me. Risk is there, so you should compare, analyze and calculate your risk factors, returns, and tax slab since you will get a share of the mutual fund.

So, Be ready for profits and losses of the fund.

There are no fixed returns from the mutual fund.

So, If you are an FD guy, I am sorry.

Usually, a mutual fund company invests in two types of financial instruments.

One is debt financing, and the second is equity financing.

When a company wants to raise funds from people, These are the only ways.

Debt financing: It means the company borrows money from others.

For example Loan from the bank, after the loan period, the company has to repay the loan amount and the interest. Another example could be money raised with the help of a bond and return along with interest.

Debentures.

So now you know the example of debt instruments.

Equity financing means the company sells its ownership in exchange for some money. People who have invested in it become shareholders of the same company.

Here, the company neither has to return the money nor pay the interest.

You can easily distinguish between equity mutual funds and mutual debt funds.

If you don’t know the debt and equity markets, you can also invest in them.

As this is the work of a Mutual Fund manager.

Earlier, if anyone wanted to invest in mutual funds, they had to learn about the stock market and find good companies for investment.

Most people are those who want to invest, but they don’t have time.

Consider your dad or elders who want to invest money but don’t have time.

For these types of people, Mutual Fund is a great option.

In India, there are 2500+ mutual fund schemes.

The mutual fund works just like shares of companies work.

The first and foremost important thing which i want you to remember is that In mutual fund is just a bridge between you and an investment product.

For this, you need to understand the concept of NAV (Net Asset Value). The mutual fund will always adjust this value according to the price of financial instruments in which the mutual fund company has invested.

NAV Units will be given to investors who invest in the mutual fund scheme. It is the price at which people buy and sell mutual fund units.

Assume that you have invested in the mutual fund scheme of Laxmi Chit Fund. This indian-based mutual fund company has invested in indian companies and some foreign companies.

You have invested Rs. 1000 in this scheme, and the price of NAV is Rs. 100, so you will have ten units of this mutual fund.

As we all know, In the stock market, demand and supply are the forces which drive the prices of stock, and it keeps on changing day to day, even second by second.

When the price of stocks in which the Laxmi chit fund has invested is also going to change identically, the price of NAV will change.

Let’s say their all combined asset’s (financial instruments) value increased by 10%; in contrast the price of NAV is going to increase by 10%

Let’s see with the numbers.

So now, the price of NAV has increased by 10%, so the new price of NAV will be Rs. 110.

Since you have 10 Units of the Laxmi chit fund, you can redeem them and sell them back to them.

You will get 10 Units X Rs. 110. = Rs. 1100.

Earlier your investment was Rs. 1000

Here you gained Rs. 100.

Now you know what is mutual fund in simple words.

Let’s see the classification of mutual funds.

There are different types of mutual fund in which one can invest. Here, I have also covered the sub-types of the mutual fund.

Whenever a new mutual fund scheme comes into the market, they come with NFO (New Fund Offer) to show the investors. The NFO is open for specific days on which investors must buy it.

Mutual funds that are permanent are open-ended, allowing you to invest and redeem investments at any time. They don’t have a set investment time and are liquid. If the mutual fund is open-ended, you can buy that even after NFO days have passed.

Those that are closed-ended have a set maturity date. Only at the time of the new fund offer may you invest, and only at maturity may you redeem. A close-ended mutual fund does not allow you to buy its units whenever you want. If NFO days have passed, you can’t buy those funds that follow a closed-end structure. If you still want to buy, you can buy these funds from stock exchanges.

Let’s say a closed-ended fund has a maturity date of 5 years, and you want to sell your units. Then you have to sell it on the stock exchange since there are fewer buyers for it, so there is a chance that you may have to sell it for less price.

Equity mutual funds are those mutual funds where the fund manager invests only in the equity market, which means they invest only in shares.

When it comes to equity mutual funds, you need to remember that it is for the long term. Every company needs time to show performance.

Don’t go with an equity mutual fund if you are a short-term investor, as equities can experience volatility in the short term.

According to market cap, there are three types mutual fund,

Market Capitalization: It is the parameter to identify the company’s size.

Companies with market capitalization from Rs. 0 to Rs.5000 crores will come in the small-cap category.

Companies with market capitalization from Rs. 5000 crores to Rs. 20000 crores will come in the mid-cap category.

Companies with market capitalization from Rs. 20000 crores + will come in the large-cap category.

Small Cap mutual funds will invest in only small-cap companies.

Mid Cap mutual funds will invest in mid-cap companies only.

Large Cap mutual funds will invest in large-cap companies only.

One thing you must remember is that small-cap companies have less financial stability and less exposure to market scenarios.

Ask yourself, if any recession comes in the market, are the small companies able to survive?

On the same, they have more chance to grow and potential too.

Corresponding to the above statement, Small companies can give you better returns too.

On the other hand,

Large-cap companies are less risky and have good financial figures to survive even in bad times.

So if you don’t like risk, you can go for large-cap companies or mutual funds.

They have less opportunity for growth, so they are known for delivering stable returns.

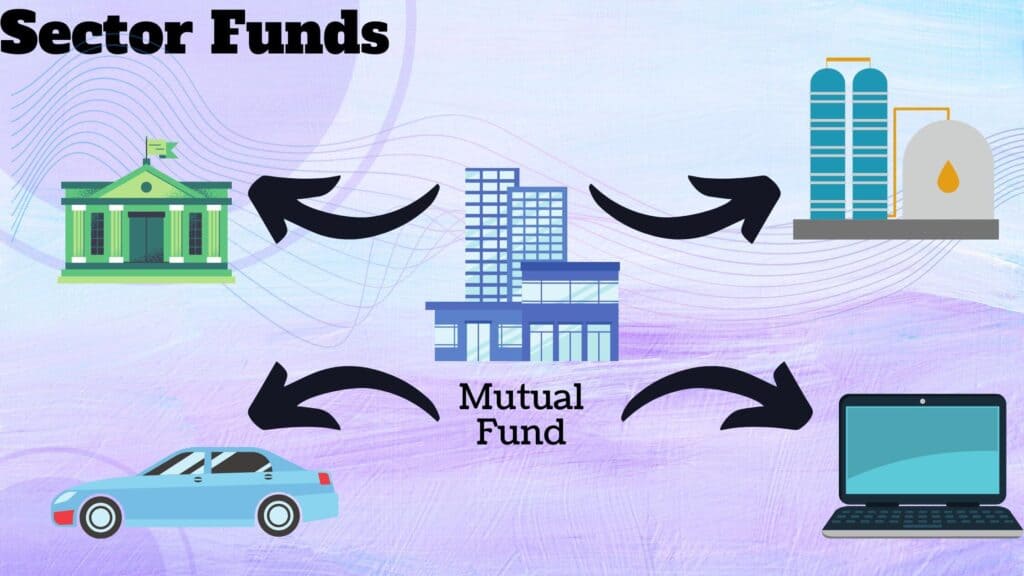

This type of mutual fund invests in a specific sector.

Let’s say they invest in the pharma sector so that the mutual fund company will invest only in pharma shares.

So If the sector is performing well, then the mutual fund will also get returns.

In my view, This can be risky as your entire investment is dependent only on one sector.

For Example, ICICI Prudential Technology Plan is a sector fund that invests only in IT stocks.

If you still want to invest in the sector funds, then you can invest in those with less impact of the recession, so if the market goes down, you still can have some returns on your portfolio.

Finance, Healthcare, and IT are some examples of sectors with less impact from the recession.

These types of funds invest in a specific theme. For example, Aditya Birla Sun Life Manufacturing Equity Fund is based on the theme of manufacturing, so this fund invests in only those companies engaged in manufacturing. If the manufacturing sector is doing great, those shareholders will get the benefit invested in the thematic fund of manufacturing.

Let’s look at the mutual fund portfolio of Aditya Birla Sun Life Manufacturing Equity Fund.

This fund has invested in

Reliance Industries Ltd. (Oil & Gas)

ITC Ltd. (Tobacco and FMCG)

Tata Steel Ltd. (Steel)

Asian Paints Ltd. (Paints)

Try to note this: All companies belong to different sectors, but all manufacture their goods independently.

Here comparatively, the risk is low compared to the sector fund, as different sectors got covered in this fund.

If you are the one who is more inclined towards tax, then this is for you.

It is a Tax-savings scheme. The investment made through ELSS is tax-deductible under Section 80C of the Income Tax Act of 1961 up to Rs 1.5 lakh yearly. ELSS also has a three-year lock-in period from the date of investment.

Now, if your income is above Rs. 5,00,000 each year, you can take advantage of ELSS and invest in it.

It is mostly for the beginner who is new to the finance world.

It can also help you with taxes, It comes under Income Tax Section 80CCG, where you get a deduction of 50%, and the maximum tax benefit you can take from this scheme is Rs. Rs. 25,000.

So, Let’s say you invest Rs. 40,000 in Rajiv Gandhi Equity Savings Scheme, then you can take a tax benefit of 50% of Rs. 40,000, which is Rs. 20,000.

To invest in this,

-You should be a new retail investor.

-Your Income should be lower than Rs. 12 Lakhs.

-This scheme has a Lock-in period of 1 year.

This scheme has started to promote investing so that new investors start investing in the capital market.

Here, You can get more details about this scheme.

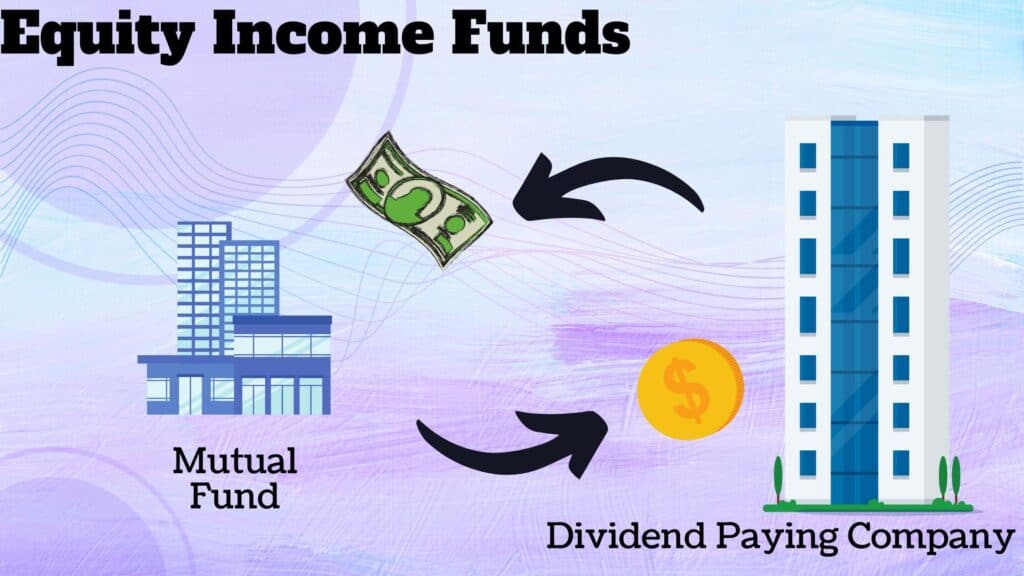

Equity Income funds invest in the equity of those companies that reward their shareholder with dividends.

Dividend: It is the money that shareholders distribute to their shareholders.

For Example, Templeton India Equity Income fund is an equity income fund. Let’s check the mutual fund portfolio.

They have invested in the following:

-Infosys Ltd.

-ITC Ltd.

-Coal Ltd.

-HCL Technologies Ltd.

These companies regularly pay dividends to their shareholders.

That’s why these schemes are also known as dividend yield schemes.

If a company is paying dividends, there is no guarantee that it will also give you dividends in the future.

The name itself tells many things about this fund. These funds invest in international companies not listed on the Indian stock exchange.

The US is an economic leader and stock market leader too.

Economists and analysts in India also track the movement of the dow jones index to predict the market.

Not only Indians but economists from all over the world keep their eye on the US stock market.

This fund invests in international equities to provide geographical diversification to its investors.

For example Aditya Birla Sun Life International Equity Fund. This fund has invested in overseas companies.

Let’s see mutual fund portfolio.

-Kellogs Co

-Imperial Brand PC

-British American Tobacco PLC

-State Street Corp

Before this, Let’s see the main indices of the Indian stock market.

Indices measure the price performance of a set of shares of the corresponding stock exchange. In India, the two famous stock exchanges are NSE and BSE, and their indices are NIFTY 50 and SENSEX.

So if you invest in an index fund, your money will be invested into those companies on the list of these indices.

Here, a mutual fund’s management fees are very low because this is a passive fund.

Debt mutual funds are those mutual funds where the fund manager invests only in the debt market, which means they invest only in debt instruments such as debentures, bonds, T-bills, etc.

Here you can invest your money in the short term and long term.

Gilt Funds invests in government securities such as treasury bills and government bonds. They invest in those debt instruments with 3-5 years of maturity.

Now, I think what i like about these types of mutual fund is that it is risk-free. Since you are buying bonds from the government and for sure, the government is going to pay you along with principle and interest amounts.

There is no credit risk in the case of Gilt Funds.

Now, you know that these mutual funds invest in instruments with a maturity period of 3-5 years; therefore, you must stay invested in them for the same period.

These funds invest in government and private securities such as government bonds, t-bills, corporate bonds, commercial papers, etc.

Since there is no credit risk in government securities, there is credit risk in private securities, making the diversified debt funds a risky fund.

These are those funds that invest in low-quality bonds of a non-government organization.

They are risky as well. They have high credit risk.

Since these funds have high credit risk, they offer high-interest rates to their investors.

They offer high interest to attract retail investors from the market.

These funds follow the structure of closed-ended funds and invest in government securities and corporate bonds. They hold the bonds till the date of Maturity.

Here, the Maturity of these funds depends on the government securities.

For example: If the maturity period of government bonds is 5 years, then the mutual fund also has a maturity period of 5 years.

These funds invest in those type of debt securities whose interest rates vary as per market conditions.

There is no fixed interest rate. Therefore returns are purely dependent on market conditions which can be risky.

These funds invest in debt securities with a maturity period of fewer days. It can also be considered a short-term investment. Generally, it is for 91 days.

There is no lock-in period for these funds. These funds are also known as money market schemes.

These funds can offer you more returns than your savings account. This can be a great alternative to liquid funds.

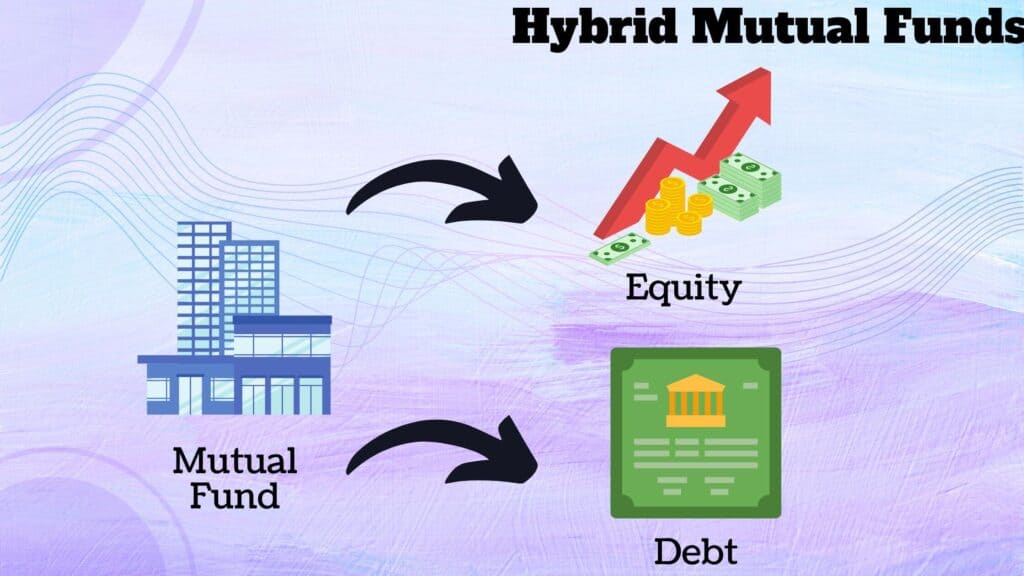

Hybrid funds are those funds that invest in both financial instruments, i.e., equity and debt.

Balance funds invest in both. The name itself tells the objective of this fund. This fund always tries to make the balance between Equity and debt.

For Growth, they invest in Equity, and for regular income, they invest in debt.

The threshold limit for these funds to invest in Equity is 65%, and debt is 35%.

Balance funds invest in both. As the fund wants monthly income, they try to invest most of the money in debt instruments.

As they earn monthly income, so they declare dividends for their shareholders.

Here, the fund ensures that the capital you have invested will be protected.

You won’t get negative returns from this fund.

You will get the principle amount, and there is no guarantee of interest, so to protect investors’ capital, they invest in government securities.

By investing in government securities, they get fixed returns.

This fund follows the closed-ended structure.

Fund managers operate these funds. They analyze the market and then invest. Fund managers will take the decision. Most of the mutual funds are active mutual funds since these types of funds are managed by mutual fund managers so there is a management fee that is little more as compared to passive funds.

Fund managers do not operate these funds. Index fund follows passive investing as it just follows the indices of the market.

Mutual funds provide Indian investors with a tried-and-true way to grow their capital more quickly than conventional investment products. Higher yields, capital growth, income generation, inflation protection, and the ability to generate cash to satisfy various long- and short-term demands are all potential benefits.

Mutual fund works in same every in every country so don’t be confused with what is mutual in India and what is mutual fund in US.

The reason why I love mutual is just that it can give diversification to your portfolio by investing in international stocks.

I use mutual fund schemes for those investment products where i find difficulties investing or have to invest with high capital. This is the true mutual fund meaning for me.

Before investing, read all about different types of mutual funds and check mutual fund examples.

Let’s say you are a retail investor in India and want to invest in APPLE Inc., listed on NYSE, i.e., New York Stock Exchange.

Here, you can invest in APPLE in two ways, one is direct, and one is indirect.

The direct way is to open a trading account with a US broker and buy the shares of APPLE Inc.

Indirectly, you can invest in that mutual fund, which has invested in APPLE Inc.

The mutual fund gives your global exposure. Mutual fund works

I hope you enjoyed this blog and came to know about what is mutual fund and its types.

If you have any queries, leave your comment i will respond to it.

Thank You

Logging Out!

Rupay Rajat

Rupay Rajat is a financial and investing blog. I write about financial instruments and the stock market in the most easiest language.

Latest Post

Let’s Unveiling the Power of Compounding in the Stock Market

Mutual fund vs Fixed deposit – Where should you Invest?

How to invest in Mutual Funds? Easy Ways to Invest

What is Mutual Fund? Simple Types of Mutual Fund

29 Best Stock Market Websites (Useful Websites and Apps)

What is the difference between share market and stock market?

How the Stock Market Works in an Unusual Way

What is the Buyback of shares? What happens after Buyback?

What is Bonus Share? How Can I get One?

What is Stock Split? What will happen to shares after that?

What is the Book Value of a share? Valuation Metric of Share

What is the Face Value of the Share? Importance, Example

What are the voting rights of a shareholder? Importance

What is an Adjustable peg? Effect of Forex Market

What is Adhoc Margin? Who Collects from Whom?